Defense Daily

-

Congress

CongressSASC Leaders Criticize Trump’s Defense Strategy, Press Colby On Policy Shifts

Senate Armed Services Committee (SASC) leadership on Tuesday criticized the Trump administration’s new National Defense Strategy (NDS) and pressed the Pentagon’s top policy official to explain the document’s priorities. SASC […]

-

Space

SpaceAeroVironment Investing In Albuquerque Expansion As SCAR Negotiations Continue

AeroVironment, Inc. [AVAV] is investing in expansion in Albuquerque, N.M., as the company continues negotiations with the Space Force on the provision of Satellite Communication Augmentation Resource (SCAR) antennas for […]

-

Navy/USMC

Navy/USMCDIU Seeks Larger Capacity Autonomous Low Profile Sea Vehicles For Shore Resupply

The Defense Innovation Unit (DIU) has issued a new solicitation seeking more solutions for larger capacity Autonomous Low Profile Vehicles (ALPV) that can help resupply forces ashore in contested environments. […]

Tagged in: -

Advanced / Transformational Technology

Advanced / Transformational TechnologyX-Bow Begins Hot-Firings Of Large Solid Rocket Motor For Hypersonic Applications

X-Bow Systems last month conducted the first static firing of its largest solid rocket motor (SRM) yet, the XB-34, a self-funded 34.5-inch diameter motor the company is designing to be […]

-

Air Force

Air ForceUSAF Looks To Replace Radios On HH-60Ws

The U.S. Air Force is looking to replace the Link-16 TacNet Tactical Radios (TTRs) by RTX‘s [RTX] Collins Aerospace on the service’s fleet of Lockheed Martin [LMT] HH-60W Jolly Green […]

-

Advanced / Transformational Technology

Advanced / Transformational TechnologyRocket Lab Lifts Scramjet-Powered Air Vehicle For DIU Hypersonic Test

Rocket Lab [RKLB] last week launched a modified version of its suborbital launch vehicle to release a scramjet-powered 3D-printed air vehicle in support of a hypersonic test program managed by […]

-

Tuesday, March 3, 2026

- Hegseth, Caine Offer Details On Iran Strike Campaign, U.S. Has Employed ‘Classified Effects’

- Daily Use Of Several Thousand Munitions Over Several Months Would Strain U.S. Inventory

- Army Details New Co-Investment Initiative With Private Sector To Bolster Tech, Industrial Base Efforts

- Sub Forces Commander Pushes To Maintain SSN(X) Support, Continue Unmanned Development To Keep Advantage Over China

- U.S. Confirms First Combat Use Of Low-Cost, One-Way Attack Drones In Iran Strikes

- L3Harris Names New CFO, Freeing Bedingfield To Run Missile Solution Business

- RG-XX To Highlight New Space Force Acquisition Approach

- Hermeus Flies Again With New Quarterhorse Unmanned Aircraft

-

Tuesday, March 3, 2026

- Hegseth, Caine Offer Details On Iran Strike Campaign, U.S. Has Employed ‘Classified Effects’

- Daily Use Of Several Thousand Munitions Over Several Months Would Strain U.S. Inventory

- Army Details New Co-Investment Initiative With Private Sector To Bolster Tech, Industrial Base Efforts

- Sub Forces Commander Pushes To Maintain SSN(X) Support, Continue Unmanned Development To Keep Advantage Over China

- U.S. Confirms First Combat Use Of Low-Cost, One-Way Attack Drones In Iran Strikes

- L3Harris Names New CFO, Freeing Bedingfield To Run Missile Solution Business

- RG-XX To Highlight New Space Force Acquisition Approach

- Hermeus Flies Again With New Quarterhorse Unmanned Aircraft

-

Navy/USMC

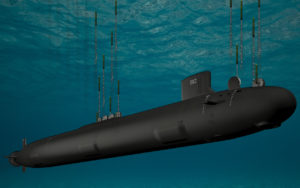

Navy/USMCSub Forces Commander Pushes To Maintain SSN(X) Support, Continue Unmanned Development To Keep Advantage Over China

The commander of Naval Submarine Forces on Monday argued it is “critically important” the government continues supporting the SSN(X) next generation nuclear-powered attack submarine program to maintain its advantage over […]

Tagged in: -

Army

ArmyArmy Details New Co-Investment Initiative With Private Sector To Bolster Tech, Industrial Base Efforts

The Army on Monday announced a new initiative to bring in the private sector as co-investors to help fund efforts ranging from technology modernization to bolstering the defense industrial base. […]