Defense Daily

-

Uncategorized

UncategorizedU.K. Gets FMS Nod For Navy AEHF Multiband Terminals

The State Department on Monday said it approved a potential million Foreign Military Sale (FMS) to the United Kingdom for six Advanced Extremely High Frequency (AEHF) Navy Multiband Terminals, bringing […]

-

Navy/USMC

Navy/USMCNavy To Hold Industry Day For New Rapid Capabilities Office

The Navy recently announced that it plans to hold an industry day and investor briefing for the newly established Rapid Capabilities Office (RCO), which the Secretary of the Navy established […]

Tagged in: -

Unmanned Systems

Unmanned SystemsPending Multiple Award DHS-Wide Counter-Drone Contract Worth $1.5 Billion

The Department of Homeland Security (DHS) last Friday evening released a Request for Proposal (RFP) for a multiple award contract worth up to $1.5 billion that its components and agencies […]

-

Air Force

Air ForceUSAF To Award Pratt & Whitney Engine Performance Restoration Contract For C-17 By End Of FY 2027

The Air Force plans to award a 10-year firm fixed price contract at the end of fiscal 2027 to RTX‘s [RTX] Pratt & Whitney for the restoration of the company’s […]

-

Navy/USMC

Navy/USMCAussie AUKUS Base Will Connect To Undersea Internet Cables

Australia’s HMAS Sterling naval base, which will house U.S.-made Virginia-class submarines as part of the AUKUS program in 2027, will be connected to three undersea internet cables, according to Reuters. […]

-

Missile Defense

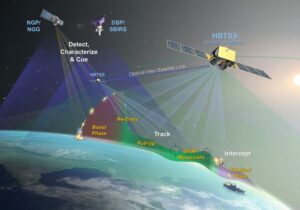

Missile DefenseSpace Force Prepares Golden Dome Solicitation For Midcourse Interceptors

The U.S. Space Force is to release a Request for Prototype Proposal (RPP) for what experts have said is the most feasible version of space-based missile defense–midcourse kinetic intercept. Space […]

Tagged in: -

Business/Financial

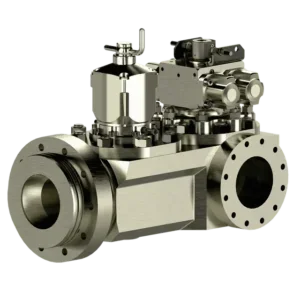

Business/FinancialFairbanks Morse Defense To Acquire Naval Supplier Truflo Marine

Fairbanks Morse Defense (FMD) on Monday said it has agreed to acquire United Kingdom-based Truflo Marine in a deal that expands its current work in valve design and manufacturing and […]

-

Monday, November 24, 2025

- Defense Watch: Golden Dome, FMS Deals, Army Noms, C-UAS

- Integration Of Space Development Agency Tranches Faces Challenge, Report Says

- Navy To Establish Drone ISR Services Through Basic Ordering Agreements

- Army Explores Developing C-sUAS Interceptor, Seeks Info On Potential Components

- DoD Strategic Capital Office To Loan $700 Million To U.S. Supply Of Rare Earth Elements

- U.S., Canada And Finland Emphasize Icebreaker Workforce Development In New Statement

-

Monday, November 24, 2025

- Defense Watch: Golden Dome, FMS Deals, Army Noms, C-UAS

- Integration Of Space Development Agency Tranches Faces Challenge, Report Says

- Navy To Establish Drone ISR Services Through Basic Ordering Agreements

- Army Explores Developing C-sUAS Interceptor, Seeks Info On Potential Components

- DoD Strategic Capital Office To Loan $700 Million To U.S. Supply Of Rare Earth Elements

- U.S., Canada And Finland Emphasize Icebreaker Workforce Development In New Statement

-

Army

ArmyArmy Explores Developing C-sUAS Interceptor, Seeks Info On Potential Components

The Army is exploring development of a new interceptor for countering small drones, and is seeking information from industry on seekers and other small form factor components that could support […]