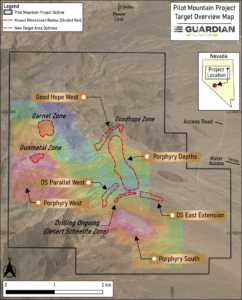

A London-based company with operations focused solely in Nevada expects to begin tungsten mining operations in 2028--the first U.S. tungsten mines in years amid ongoing Chinese export restrictions of the critical metal used in a variety of defense products. This week the Defense Department awarded a subsidiary of Guardian Metal Resources Plc $6.2 million for the engineering component of a pre-feasibility study for the Pilot Mountain tungsten mining site in Western Nevada. Guardian Metal is nearing the completion of drilling…

By

By