Defense Daily

-

Advanced / Transformational Technology

Advanced / Transformational TechnologyCoast Guard Establishes Rapid Prototyping Office

As part of initiative launched earlier this year to boost the Coast Guard’s resources to enlarge the service and make it more agile and responsive, the service last Friday announced […]

-

Navy/USMC

Navy/USMCNavy Should Consolidate Command-And-Control Platforms For Unmanned Vessels, Official Says

The Navy has more command-and-control platforms than it needs and should limit these to ensure more constancy across its fleets, the officer in charge of technology and innovation at the […]

-

Unmanned Systems

Unmanned SystemsEstonian Conference This Month May Dovetail With Pentagon Swarm Forge Effort

Florida’s Ondas Inc. [ONDS] established its Ondas Capital business unit last September to invest $150 million in two years to scale up “mature and combat-proven defense technologies” initially focused on Ukraine. […]

-

Friday, January 16, 2026

- Head Of U.S. Fleet Forces Command Outlines Navy Need For Larger Missile Stable

- Battleship Solves The Weapons Choice DDG(X) Faced, Navy Official Says

- Anduril To Deliver More Than 600 Bolt-Ms For Marines’ OPF-L Loitering Munition Program

- USAF To Pursue Degraded Visual Environment System For HH-60W Without Helmet Mounted Display

- U.S. OKs Potential $1.5 Billion Deal With Peru For Naval Base Work, New FMS With Kuwait, Iraq

- HII Doubles The Size Of UK Unmanned Vehicle Facility

- Parsons Acquires Altamira For $375 Million, Strengthening Defense And Intelligence Work

- Seasats Discloses $24 Million APFIT Award For Lightfish ASVs

-

Friday, January 16, 2026

- Head Of U.S. Fleet Forces Command Outlines Navy Need For Larger Missile Stable

- Battleship Solves The Weapons Choice DDG(X) Faced, Navy Official Says

- Anduril To Deliver More Than 600 Bolt-Ms For Marines’ OPF-L Loitering Munition Program

- USAF To Pursue Degraded Visual Environment System For HH-60W Without Helmet Mounted Display

- U.S. OKs Potential $1.5 Billion Deal With Peru For Naval Base Work, New FMS With Kuwait, Iraq

- HII Doubles The Size Of UK Unmanned Vehicle Facility

- Parsons Acquires Altamira For $375 Million, Strengthening Defense And Intelligence Work

- Seasats Discloses $24 Million APFIT Award For Lightfish ASVs

-

International

InternationalU.S. OKs Potential $1.5 Billion Deal With Peru For Naval Base Work, New FMS With Kuwait, Iraq

The U.S. has approved a potential $1.5 billion deal with Peru for the design and construction of maritime and onshore facilities at the country’s Callao Naval Base. Along with the […]

-

International

InternationalHII Doubles The Size Of UK Unmanned Vehicle Facility

HII [HII] this week announced it has completed an expansion to double the size of its unmanned vehicle facility in Porchester, United Kingdom, strengthening its capability as a regional hub […]

Tagged in: -

Navy/USMC

Navy/USMCAnduril To Deliver More Than 600 Bolt-Ms For Marines’ OPF-L Loitering Munition Program

Anduril Industries has received its first production award for the Marine Corps’ Organic Precision Fires-Light (OPF-L) lightweight loitering munition program, receiving $23.9 million to deliver more than 600 of its […]

-

Navy/USMC

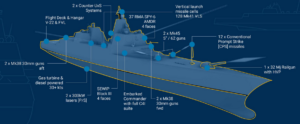

Navy/USMCBattleship Solves The Weapons Choice DDG(X) Faced, Navy Official Says

The Navy was facing a choice between either fielding hypersonic weapons or keeping a planned naval gun on the DDG(X) future destroyer program until the Trump administration’s push to supersede […]

Tagged in: -

Navy/USMC

Navy/USMCHead Of U.S. Fleet Forces Command Outlines Navy Need For Larger Missile Stable

The Navy needs a significantly larger stable of missiles, such as the more than $2 million unit cost Tomahawks and Standard Missiles (SMs) by RTX‘s [RTX] Raytheon in order to […]