Defense Daily

-

Intelligence Community

Intelligence CommunityNGA Close To Operational Use Of New GEOINT Tasking Tool For Combatant Commands

ST. LOUIS—A new version of the National Geospatial-Intelligence Agency’s (NGA) primary tool for ordering imagery should be ready for operational use later this year, an agency official said. The tailored […]

-

Air Force

Air ForceAllvin: F-47 Development ‘Can Come at the Speed of Software, not Hardware’

The U.S. Air Force has more control over the development of the Boeing [BA] F-47 fighter than the service has had for the Lockheed Martin [LMT] F-35 Lightning II, Air […]

Tagged in: -

Air Force

Air ForceUSAF, Anduril, General Atomics Market CCA

While U.S. Air Force Chief of Staff Gen. Dave Allvin posted on X on May 1 that the two Collaborative Combat Aircraft (CCA) prototypes–Anduril Industries‘ YFQ-44A Fury and General Atomics‘ […]

Tagged in: -

Homeland Security

Homeland SecurityCBP Upgrading Mobile Surveillance Systems With Radar From SRC To Improve Border Security

Benchmark Electronics [BHE] is upgrading its Mobile Video Surveillance Systems [MVSS] with a radar provided by SRC to increase range and add autonomy for border security operations. Customs and Border […]

-

Uncategorized

UncategorizedFirst Production Unit of B61-13 Gravity Bomb Complete, Pantex Says

The first production unit of the B61-13 gravity bomb is complete, nearly a year ahead of schedule, Pantex Plant prime PanTeXas Deterrence said Monday. The first production unit was completed […]

-

Uncategorized

UncategorizedKilby, Strategic Systems Lead Weigh ‘Alternatives’ For SLCM-N

Adm. James Kilby, acting Chief of Naval Operations, said last week that he was in talks with the director of Strategic Systems Programs on nuclear-armed, sea-launched cruise missile (SLCM-N) alternatives. […]

-

Advanced / Transformational Technology

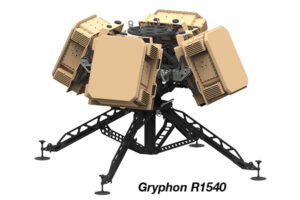

Advanced / Transformational TechnologySRC Details New R1430/1440 And R1540 Multi-Mission Radars

SRC Inc. on Tuesday detailed the expansion of its Gryphon family of multi-mission radars with the new R1430/R1440 and R1540 systems, noting the latter has been “extensively deployed with the […]

-

Tuesday, May 20, 2025

- IC Exploring How To Reform Procurement Process To Expand Opportunities, Gabbard Says

- Key Geospatial Intel Lesson Of Ukraine War Is Closing Kill Chain, NATO Official Says

- Bell ‘Confident’ In Meeting Army’s FLRAA Acceleration, First Prototype Delivery In 2027

- Space Force Awards LeoLabs $14 Million For Space Domain Awareness Radar In Indo-Pacific

- Unarmed Minuteman III Test launch Scheduled for Wednesday Morning

- Mack Defense Nabs Marine Corps Deal To Build Medium Tactical Truck Prototypes

- Kilby: HELIOS Laser Weapon Problems Delayed Testing, Not At Full Power

- Intelligence Community-Focused Vibrint Acquires Ampsight Adding New Customers

- Electric Boat And UAW Union Avoid Strike In Tentative Agreement

- As USAF Looks to Future Requirements for CCA Radars, Raytheon Announces First Flight of PhantomStrike

- Los Alamos Plutonium Facility Moves Into 24/7 Operations, DNFSB Reports

- NGA Plans Upcoming Commercial Analytics Awards In Several Areas

- USAF Cites ‘Design, Production, and Installation Cost Increases’ for B-52 RMP Breach

- Commercial Satellite Imagery Leaders See Increased International Demand

-

Navy/USMC

Navy/USMCMack Defense Nabs Marine Corps Deal To Build Medium Tactical Truck Prototypes

The Marine Corps has awarded Mack Defense a deal to build two prototypes for its Medium Tactical Truck (MTT) program, which will inform a potential replacement for its Medium Tactical […]

-

Tuesday, May 20, 2025

- Commercial Satellite Imagery Leaders See Increased International Demand

- Key Geospatial Intel Lesson Of Ukraine War Is Closing Kill Chain, NATO Official Says

- Bell ‘Confident’ In Meeting Army’s FLRAA Acceleration, First Prototype Delivery In 2027

- Electric Boat And UAW Union Avoid Strike In Tentative Agreement

- USAF Cites ‘Design, Production, and Installation Cost Increases’ for B-52 RMP Breach

- Mack Defense Nabs Marine Corps Deal To Build Medium Tactical Truck Prototypes

- Intelligence Community-Focused Vibrint Acquires Ampsight Adding New Customers

- Los Alamos Plutonium Facility Moves Into 24/7 Operations, DNFSB Reports

- IC Exploring How To Reform Procurement Process To Expand Opportunities, Gabbard Says

- Kilby: HELIOS Laser Weapon Problems Delayed Testing, Not At Full Power

- As USAF Looks to Future Requirements for CCA Radars, Raytheon Announces First Flight of PhantomStrike