The president and CEO of HII [HII] this week downplayed how much impact Trump administration aluminum and steel tariffs would have on the shipbuilding supply chain while noting adding Australian suppliers to submarine production under the AUKUS agreement will help bolster a fragile supply chain.

He argued that as a long-term shipbuilder HII is different from other companies because they both order metal parts years in advance and also buy and build in America.

“Ultimately, if tariffs bring more manufacturing into the United States and creates more jobs for manufacturing workers in the United States. I’m happy, because we need to broaden that base. We need to have more workers, more manufacturing workers in the United States,” Chris Kastner told reporters during a media roundtable Wednesday ahead of next week’s Sea Air Space conference in National Harbor, Md.

Kastner was unwilling to game out the “secondary or tertiary effects of potential tariffs. Tariffs is not a story for us. It just isn’t.”

President Trump imposed a 25 percent tariff on steel and aluminum in mid-March.

Despite Kastner’s statements trying to minimize the effect from the tariffs, a Navy official last week admitted to a Senate panel that they very well could drive up ship costs.

Acting Assistant Secretary of the Navy for Research, Development, and Acquisition Brett Seidle told a Senate panel in 2023 about half of the aluminum and a third of its steel for Navy shipbuilding came from Canada and “clearly, tariffs in those areas could drive costs” (Defense Daily, March 27).

During the hearing, Sen. Tim Kaine (D-Va.) asked if it would be easy or hard to go from sourcing 66 percent to 100 percent domestic steel in shipbuilding. When Seidle said he did not have the specific information on that change, Kaine responded, “it’d be hard.”

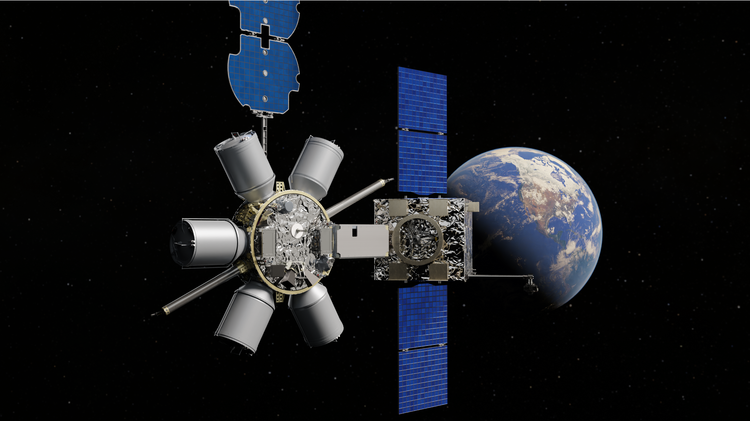

Separately, Kastner said the utility in adding Australian companies to the submarine industrial base under AUKUS adds needed capacity to a fragile industrial base but will not lower prices.

“So I don’t think there’s an immediate impact. I think having additional capacity in the submarine industrial base is only positive. And so if there are suppliers in Australia that are qualified to produce sub safe equipment and can participate. It’s only positive,”Kastner said.

Last month, the Australian government awarded HII’s Australian subsidiary a $6 million contract to deliver a new submarine supplier qualification pilot to help small and medium Australian companies qualify to enter the U.S. submarine industrial base supply chain (Defense Daily, March 11).

Also, last month HII named VEEM Ltd. as the first company to join the supplier program. VEEM already has decades of experience in precision casting for the Australian Collins-class submarine (Defense Daily, March 19)

“Do I think it’s going to be a significant impact to cost? I don’t, not at this point, but we have a very fragile supply chain right now, so having additional suppliers that can produce this equipment, I think, is only positive,” Kastner continued.

Kastner also said while he could not identify a single weakest link in the Navy shipbuilding supply chain, he cited the general lack of capacity.

“20 years ago, if something broke through the test program, you either had it on your end in inventory, you had it at the supplier inventory, or you had it on another ship that you could pull it from, so you could quickly continue with your test program. Now you may not have it available, and you have to go reorder and get in line.”

Kastner said this significantly decreases efficiency, impacting test sequencing and test programs.

“It’s just a general lack of capacity throughout the entire supply chain as we’re going through a significant increase in demand. So it’s not a specific area, it’s just very broad.”