Just as it closed 2024, General Dynamics [GD] opened 2025 financial results with double-digit top and bottom-line increases powered by gains across its operating segments, in particular Aerospace which benefited from a 50 percent increase in business jet deliveries, the company reported on Wednesday.

Net income in the first quarter was up 24 percent to $944 million, $3.66 earnings per share (EPS), from $799 million ($2.88 EPS) a year ago, topping consensus estimates by 16 cents per share. Segment operating margin increased 70 basis points to 10.4 percent.

Sales increased 14 percent to $12.2 billion from $10.7 billion a year ago.

The Aerospace Segment was out in front with sales and operating income up 45 and 69 percent, respectively, mainly on the higher jet deliveries and a solid contribution from its aircraft services business. Supply chain issues in the segment continue to abate in terms of schedule and quality, Phebe Novakovic, GD’s chairwoman and CEO, said on the company’s earnings call.

Despite tariff concerns and related caution by customers, interest for business jets in the U.S. and Middle East for business jets remains strong, Novakovic said. She declined to speculate on potential impacts to the company this year from U.S. and reciprocal tariffs, offering that GD’s defense businesses are unlikely to “get hit much,” while the Gulfstream business jet division will have “some…impacts.”

Sales in the three defense segments were up in the mid-to-high single digits, led by Marine Systems construction of the Columbia- and Virginia-class submarines, and DDG-51 destroyers. Operating income the segment was also up consistent with sales growth and demand remains strong, she said.

The marine supply chain continues to suffer from “delays and quality problems,” Novakovic said, adding that “new shipbuilders continue to come down learning curves.” She also said that a draftsmen union that “converts engineering specs to drawing has voted to authorize a strike.”

GD has been able to hire and train employees to support shipbuilding growth, she said.

The Technologies segment enjoyed an 11 percent increase in operating income led by the Mission Systems division on strong performance.

“Their focus on advanced technology, enabling autonomous platforms, smart munitions, subsea warfare and strategic deterrence, as well as advanced AI, cloud, cyber and quantum solutions is driving demand for the group,” Novakovic said.

Technologies, in particular the GDIT division, is facing a “significant amount of uncertainty” as the Trump administration assesses its “spending priorities,” she said. While there has been some routine “sluggishness” around solicitations and awards, there is not change in segment’s outlook this year and the first quarter results, including orders, were strong and there is “a lot still to be determined” as the administration sorts out its priorities, Jason Aiken, executive vice president of Technologies, said on the call.

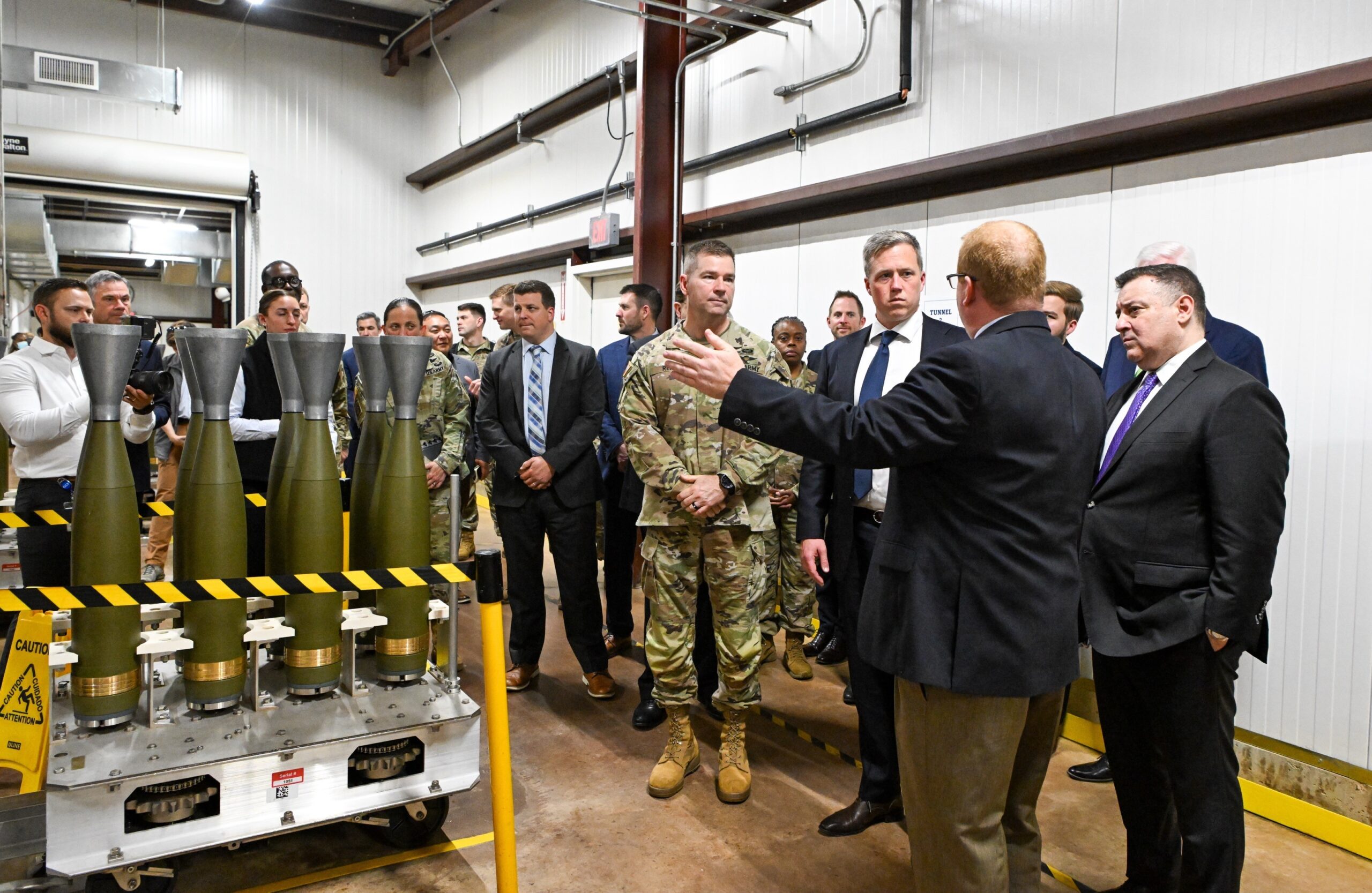

Sales and earnings were higher at Combat Systems on growth in the Ordnance and Tactical Systems, and European Land Systems businesses.

“Demand for Combat System products continues to be robust, with particular strength in Europe,” Novakovic said. “Orders for wheeled and tracked vehicles are up reflecting the heightened threat environment.”

Novakovic also highlighted new combat programs with the U.S. Army, efforts to accelerate modernization of the M1 Abrams tank, and increasing munitions capacity and production.

GD is maintaining its 2025 outlook and will provide an update during the second quarter earnings call in July.

Orders in the quarter were light and backlog of $88.7 billion was down 5 percent from $93.7 billion a year ago. Free cash flow was a $290 million outflow. Free cash flow performance will improve throughout the year, GD said.