The Navy’s latest 30-year shipbuilding plan, released Tuesday, provided three options again, with two of them never reaching 355 ships and not procuring ships at the service’s preferred rate.

This repeats the plan from last year that many in Congress disparaged, preferring a single guide (Defense Daily

, April 20, 2022).

The report reiterates Secretary of the Navy Carlos Del Toro’s talking point justifying the multiple options, arguing “evolving operational concepts and rapid technological changes make single-point predictions after approximately 10 years unreliable.”

Therefore, the three-pronged potential ranges of procurement and inventory options are provided “dependent on resource availability, technology development, and threat considerations.”

Last month, Del Toro confirmed the continuation of the three-option shipbuilding plan that he argued provides options for future leaders to make decisions based on the future threats that officials cannot necessarily foresee today (Defense Daily, March 16).

The report noted the Navy is still conducting a Battle Force Ship Assessment and Requirement Report (BFSAR) using the recently approved DoD Planning Scenario to provide a force structure analysis based on the newest 2022 National Defense Strategy.

The BFSAR is not due to be finished until June, so it does not inform this year’s 30-year shipbuilding report. The Navy said instead it is focused on 2024 budget request adjustments to last year’s 2023 30-year shipbuilding plan. The final BFSAR analysis is expected to inform the FY 2025 shipbuilding plan.

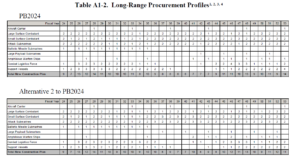

Both Alternatives 1 and Alternative 2 assume little budget growth and are constrained by 2.1 percent shipbuilding budget growth following the next five years.

Notably, Alternative 1 and 2 “do not procure all platforms at the desired rate (e.g., DDGs, SSNs, and FFGs at two ships per year).”

The Navy argued industry still needs to demonstrate it can achieve the two vessel per year rate, but the first two options at least “maximize capability within projected resources, industrial factors, and technology constraints to build the most capable force. Overall, this approach accepts risk in capacity in order to field a more capable and ready force.”

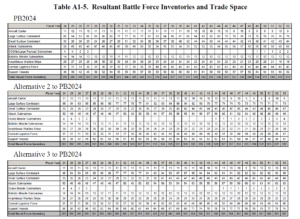

Alternative 1 predicts a total naval force inventory peaking at 331 from 2039-40 and a final level of 319 ships in 2053. Alternative 2 expects a force ceiling of 331 in 2039 and 328 ships by 2053. Alternative 3 with a significant funding boost would reach 355 ships by 2042 and peak with a 367-ship fleet by 2053.

The Alternative 1 procurement table assumes procuring two DDG-type large surface combatants most years, but falling to one per year four times between 2034 and 2048. Procurement plans for the Constellation-class frigate program continue with the current “sawtooth” 1-2-1-2 rate for five years and then procuring one per year most years from 2029 – 2034 and only then shifting to two ships per year with one shipyard Attack submarines would mostly be procured at a rate of two per year, but procurement would dip to one per year six times from 2030 – 2047.

This option also assumes a transition from the current Virginia-class attack submarines to the future SSN(X) in the “mid-2030s.”

The main difference between the first two alternatives is that Alternative 2 focuses on procuring more attack submarines and unmanned vessels. It procures both Virginia-class submarines and the next-generation SSN(X) after fiscal year 2028 rather than stopping procurement of the Virginia-class when SSN(X) begins.

However, it also would procure Flight III Arleigh Burke-class guided-missile destroyers (DDG-51) longer than the baseline 2024 budget, delaying the shift to DDG(X) future large surface combatants and procuring fewer DDG(X)s overall.

The document said this “enables a larger SSN force and procurement of a larger combat logistics force due to savings created by continuing to buy the less expensive SSN and fewer DDG(X).”

Alternative 2 also allows the Navy to procure up to one third more non-battle force ships like Large Unmanned Surface Vehicles (LUSV). LUSVs are not currently counted in the document’s inventory tables.

As a result, Alternative 2 would have 10 years when only one large surface combatant is procured, procure three frigates per year three times from 2037 to 2041, and only have one year with attack submarine procurement dipping to a single vessel while also procure three attack submarines annually during seven years in the 2030s and 2040s

The report says all three options “assumed industry eliminates excess construction backlog and produces future ships on time and within budget.”

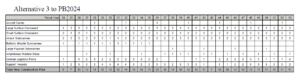

In contrast, Alternative 3 is based on what the Navy Department “assesses the industrial base could support with significant additional investment not reflected in this plan, without funding constraints.”

Assuming industry produces future ships on time and within budget, Alternative 3 represents an average of $4.4 billion in “real growth” in FY 2023 constant dollars.

The higher funding in Alternative 3 would move carriers from five- to four-year centers and also complete shifts to SSN(X) and DDG(X) while maintaining a consistent procurement of both vessels at a rate of at least two per year.

Specifically, under that procurement tables, Alternative 3 maintains at least 2 large surface combatants annually, with four years boosting to three DDGs per year, maintaining two frigates procured annually after five more years of the sawtooth procurement, and procuring two attack submarines annually after procuring only one in 2030 and 2031.