On Dec. 23 last year, less than a month before the handover of presidential power, the Biden administration’s U.S. Trade Representative (USTR), Katherine Tai, announced an investigation under Section 301 the Trade Act of 1974 into unfair semiconductor trade practices by China.

The office of the USTR had targeted the end of this month for the submission of public comments and for a public hearing on March 11.

Semiconductor groups are now asking for a minimum time extension of one month.

In May last year, the Biden administration called for a rise to 50 percent tariffs on Chinese semiconductors this year and a rise to 25 percent tariffs last year on critical minerals other than natural graphite.

“Given the change in administration, a better approach would be to pause the investigation entirely until the next USTR is confirmed by the United States Senate,” according to a Jan. 17 letter to USTR Acting General Counsel Juan Millan from the Semiconductor Industry Association, Telecommunications Industry Association, Consumer Technology Association, Information Technology Industry Council, National Foreign Trade Council, Software & Information Industry Association, Technology Trade Regulation Alliance, and the U.S. Council for International Business.

“We also request that a decision to extend the deadline or pause the investigation be made swiftly and issued in a new Federal Register notice in advance of the public comment deadline so that stakeholders planning to submit comments can adapt their plans accordingly,” the groups wrote. “Companies need time to conduct significant research to evaluate an extremely broad and complex market that involves multiple layers of suppliers to provide meaningful input. The current proposed comment period does not provide companies with the necessary time or space to do so and will deprive USTR of valuable input.”

In 2022, Congress passed the CHIPS and Science Act to spur the home-shoring of computer chip foundries, and Section 9903(b) of the fiscal 2021 National Defense Authorization Act gave the go ahead for what has become a network of regional hubs under the “Microelectronics Commons.” Such hubs have included Lockheed Martin [LMT], Northrop Grumman [NOC], and RTX [RTX], and newer venture-backed companies, like Anduril, Epirus, and Tignis, DoD has said (Defense Daily, Oct. 30, 2024).

“Evidence indicates that the PRC’s targeting of the semiconductor industry for dominance is leading to significant capacity expansion, artificially and unsustainably lower domestic and global prices, a protected domestic market, and emerging overconcentration of production capacity in the PRC,” USTR’s Millan wrote on Dec. 30 last year. “Evidence indicates that in just six years, China has nearly doubled its global share of foundational logic semiconductors production capacity. Based on announced new fabrication plants (fabs), China’s share is projected to reach approximately half of the world’s capacity by 2029.”

A Feb. 1 letter to USTR from retired U.S. Navy Rear Adm. Mark Montgomery, the senior director at the Foundation for Defense of Democracies’ Center on Cyber and Technology Innovation, and retired Navy Rear Adm. Isaac Harris, an adjunct fellow at the foundation, encouraged USTR to add silicon carbide (SiC) wafers to the Section 301 investigation, to wrap up the latter quickly, and impose penalties on China to prevent the PRC “from destabilizing the United States’ semiconductor and silicon carbide substrates industries.”

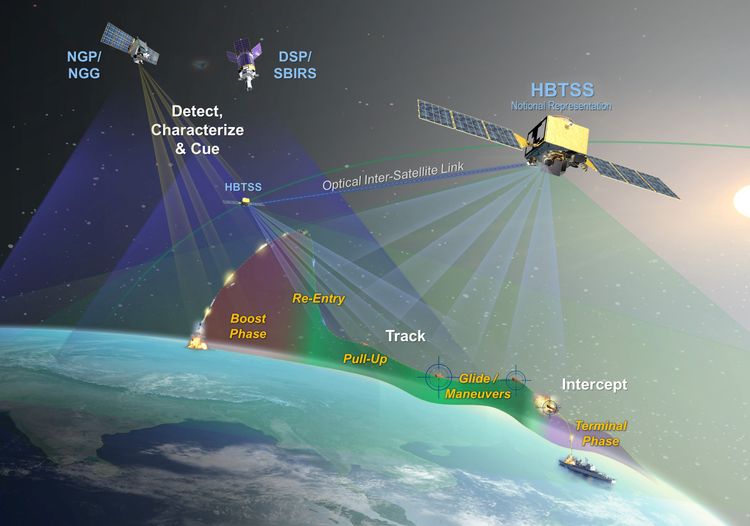

“SiC wafers are the foundation of modern technologies, from cell phones to airplanes, and have become the material of choice for high-power applications like electric vehicles, military systems, and power grids,” according to Montgomery and Harris.”As the base that semiconductors are built on, SiC wafers have proven indispensable for military systems and equipment that must operate in harsh conditions. Missile defenses, electronic warfare, and satellites are just a few of the applications that rely on semiconductors made with SiC wafers.”

“During both our naval careers, we saw first-hand how weapons systems rely on technology that must perform in severe conditions,” they said. “Today, our Navy’s most critical warfighting capability, the Aegis Combat System on the Arleigh Burke-class Destroyers, is engaging missiles and drones on a daily basis in the Red Sea. Aegis utilizes the SPY-6, the world’s most advanced at-sea radar system. SPY-6 leverages SiC for its gallium nitride modules to enhance detection range and target identification to successfully intercept ballistic and cruise missiles. Without access to SiC, we can’t use gallium nitride, which leaves our sailors vulnerable to enemy missiles.”

Industry opinion is not uniform, however, on tariffs on Chinese semiconductors, and at least one company wants an exemption.

“I am deeply concerned about the unintended consequences of these tariffs on our ability to fulfill our mission of ensuring uninterrupted operations for DoD programs,” Todd Kramer, the CEO of Norristown, Penn.-based Secure Components, wrote USTR on Jan. 6. “Secure Components serves as a lifecycle service partner to defense contractors, providing critical components and obsolescence management solutions. From the initial design and development phases to long-term sustainment, we ensure that military and defense systems maintain operational readiness throughout their entire product lifecycle. Our services include sourcing and delivering hard-to-find, obsolete components—particularly semiconductors—necessary to support the continued operation of these systems.”

“The semiconductor tariffs, while intended to curb China’s market influence, could significantly affect our ability to procure essential components needed to sustain critical DoD systems,” Kramer wrote. “Unlike the commercial sector, which has an overwhelming demand for semiconductors, the DoD represents a much smaller segment of the market, yet requires specific and often obsolete components to maintain military readiness. The tariffs would likely increase the costs of these hard-to-source parts, thereby driving up prices for DoD programs that are already facing supply chain challenges. This is contrary to the goal of supporting U.S. defense capabilities, as it could result in unnecessary cost burdens and delays for programs that are essential for national security.”