To help its federal customers implement a new efficiency effort across the government, Leidos [LDOS] is moving quickly with its own initiative to improve the success of its clients, the company’s chief executive said on Tuesday.

At the company’s investor day this summer, Leidos will unveil its new strategy, dubbed NorthStar 2030, that will outline its growth pillars that align with the direction of its customers, enjoy profitable returns, and where the company is differentiated from its competitors, Tom Bell said during a fourth quarter earnings call with investors.

“Our new [presidential] administration is moving quickly with its efficiency agenda, and Leidos is positioned to be a major contributor to the success of that agenda, building on the bold vision of our NorthStar 2030 strategy, and in light of the new administration’s priorities and the core competencies I’ve outlined, we’ve developed a set of fast paced initiatives in the Spirit of DOGE to make our customers outcomes smarter and more efficient,” Bell said.

Bell is describing Leidos as a “positive disruptor” and said the company’s current market position has it “exceptionally well placed to be a critical part of the solution, so seizing this opportunity remains our top corporate priority.” The company is “executing a purposeful campaign” to this end, he said.

DOGE refers to the Department of Government Efficiency, a task force led by President Donald Trump’s confidant Elon Musk charged with rooting out waste, streamlining operations, and in some cases either privatizing or shifting to fixed-price contracts within the federal government.

Bell’s support for the DOGE mirrors that spouted by other aerospace and defense corporate leaders the past month as the legacy defense industry aligns itself with the messaging of the Trump administration.

Leidos initiated its strategy review a year ago and at the time Bell called out disruptive technologies already in Leidos’ wheelhouse that include trusted mission artificial intelligence, autonomy, full spectrum cyber, secure rapid software, hypersonics, and electronic warfare (Defense Daily, April 30, 2024). The growth pillars will be areas for “over investment” by Leidos, Bell said on Tuesday.

Of the focus areas being pursued by the DOGE and administration, Leidos is already strongly positioned, including the modernization of government information technology infrastructure, rapidly delivering transformational warfighting capabilities such as unmanned and autonomous solutions and affordable mass, and more public-private partnerships to boost outcomes, he said.

Leidos is also well positioned to pursue emerging opportunities in two key administration priorities, the Iron Dome of America homeland missile defense system, and border security, Bell said. The company’s Indirect Fires Protection Capability Increment 2 that is being purchased by the Army, initially as part of the Defense of Guam system, can be deployed to U.S. borders to protect against cruise missiles and drone threats, he said.

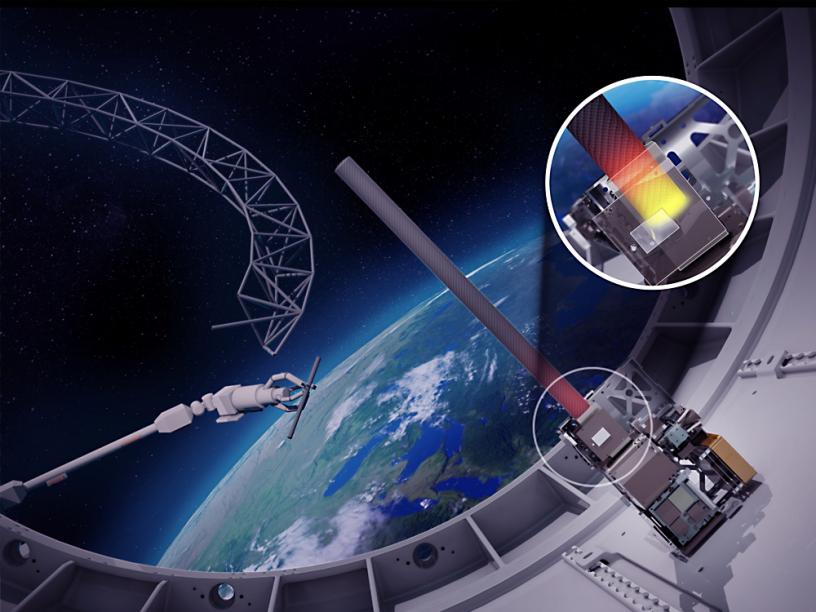

Bell also highlighted the company’s missile tracking sensors that are part of the Space Development Agency’s Proliferated Warfighter Space Architecture. Leidos is answering a new information request by the Missile Defense Agency for thoughts on the Iron Dome, he said.

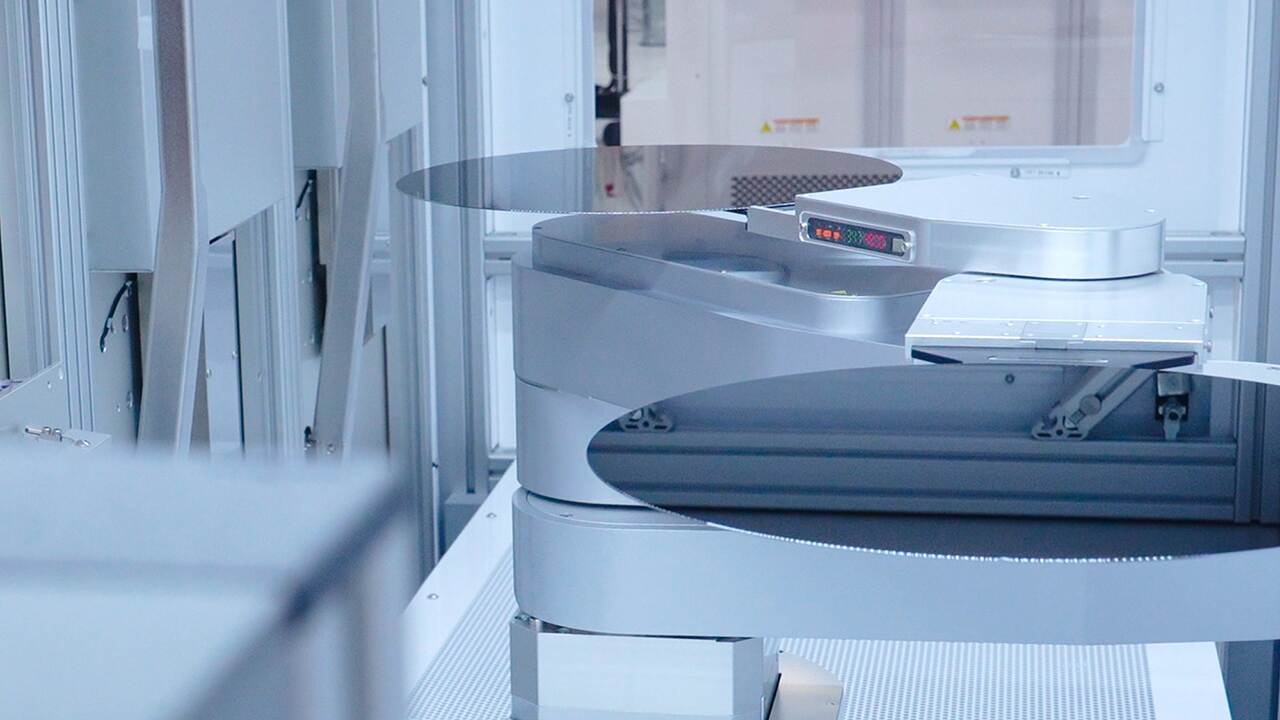

Leidos offers a variety of security detection systems used in border and transportation security that Bell said fit with the administration’s demands.

“So again, another reason we’re so optimistic that this environment and this administration’s priorities present tremendous opportunities for Leidos’ growth in the future,” he said, adding that the company is “seeding that field with our ideas” and finding a “very receptive set of stakeholders who want to hear from us and are eager to advance that conversation at pace. So, very exciting times indeed.”

Leidos ended a handsome 2004 with strong fourth quarter financial results led by its work managing federal health services combined with increased revenue across its operating segments.

Net income rose 23 percent to $282 million, $2.12 earnings per share (EPS), in the quarter from $230 million ($1.66 EPS) a year ago. Excluding certain non-operating costs, adjusted earnings of $2.37 per share in the quarter beat consensus estimates by 10 cents. Adjusted operating margin increased 20 basis points to 11.6 percent.

Sales in the quarter increased 10 percent to $4.4 billion from $4 billion a year ago, driven by managed health services, security detection products, commercial energy, Australian IT, airborne solutions and surveillance, digital modernization, and C5ISR work.

For the year, net income climbed five-fold to $1.3 billion ($9. 22 EPS) from 2023 in large part due to a hefty goodwill impairment charge in 2023 related to the security detection business. Adjusted per share earnings were $10.21 in 2024, and adjusted margin jumped 2.1 percent to 12.9 percent. Sales in 2024 increased 8 percent to $16.7 billion.

Leidos tallied a robust $23.4 billion in orders in 2024, representing a book-to-bill ratio of 1.4 times sales, helping to drive backlog to $43.6 billion, up 18 percent from a year ago. Free cash flow for the year was $1.2 billion.

For 2025, Leidos is forecasting growth of up to 4 percent to between $16.9 billion and $17.3 billion, and adjusting earnings of between $10.35 and $10.75 EPS. The company expects adjust operating margin this year to be in the mid- to high 12 percent range, and free cash flow of about $1.2 billion.